You can also enjoy a 0% introductory interest rate on balance transfers for nine months (with a 3% transfer fee).

#COMPARE CREDIT CARDS BALANCE TRANSFER FREE#

Plus, there is no annual fee for the first year! And you get 2 free visits a year to DragonPass airport lounges.

You’ll only have to pay a 1% fee when you transfer your balance from another card. With this CIBC Credit Card with a balance transfer option, you earn 0% interest on balance transfers for up to 10 months. The CIBC Select Visa* Card is one of the best balance transfer Visa credit cards in Canada. MBNA True Line ® Mastercard ® (Non-Quebec Residents)īMO Rewards ® World Elite ®* Business Mastercard ®*įor more details, read on or click on the name of a card.īest CIBC Balance Transfer Credit Card CIBC Select Visa* Card This applies to both new and existing cards.Here is a table summarizing the different promotional offers for balance transfers or cash advances: Credit card

#COMPARE CREDIT CARDS BALANCE TRANSFER FULL#

While you have an outstanding balance transfer, interest-free days on purchases only apply if you pay the interest-free days payment in full by the due date each month. That means cash advances first, then new purchases and then your balance transfer.

A monthly repayment is requiredĮven if you have a BT offer of 0% p.a., you must make your minimum monthly payment by the due date each month for your promotional rate to continue.Ĭredit card repayments go towards paying off the highest interest first.

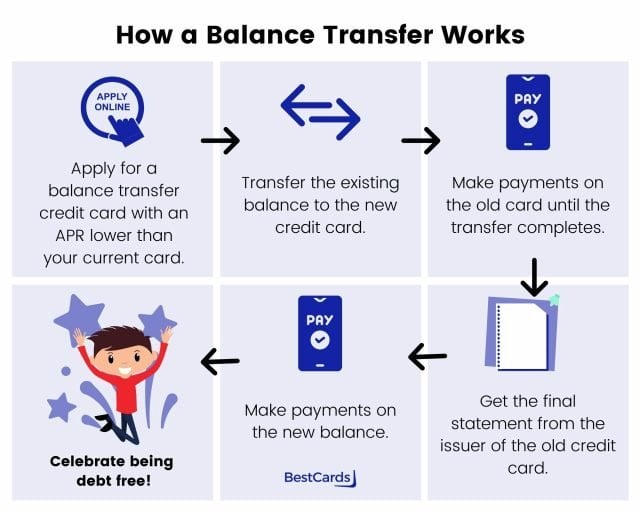

There’s a few key things to know about how balance transfers work. You might consider a BT for several reasons, such as consolidating debts to a single card or moving your debts to a card with a lower interest rate. If multiple credit card or store card debts are weighing you down, a BT on a NAB credit card can provide the breathing space you need. A balance transfer (BT) is the process of moving an amount of money that you owe from one or more credit cards to a different card, giving you a special rate on the amount you transfer.

0 kommentar(er)

0 kommentar(er)